The Internal Revenue Service has long targeted cash intensive businesses for audits. The list of potential candidates includes car washes, check cashing establishments, Laundromats, convenience stores, beauty salons, taxicabs, and of course, bail bond agencies. With premium receipts usually amounting to between 50 and 80 percent cash, bail bond agencies appear to be moving up the list rapidly.

Like many small businesses, bail bond agencies are usually lacking in internal controls. The work force generally consists of the bail agent and perhaps one or two employees. This means that office functions such as writing bail, collecting fees, and depositing receipts may all be done by the same person. In the eyes of an IRS auditor, this duplication of duties has the potential for the mishandling of cash.

As the state laws indicate, bail bondsmen are required to provide copies of documents relating to a bail transaction to the defendant and must retain all pertinent documents at his or her place of business for 5 years beyond the completion of all parts of a bail transaction. These include:

– Numbered weekly reports to the surety company

– Canceled checks for bond costs and BUF payment

– Bank statements/accounts

– Premium receipts

– Collateral receipts

– Bail agreement

– Surety contract

An IRS auditor would expect you to have these on hand either in hard copy or electronically.

Internal Sources of Information

The Currency and Banking Retrieval System (CBRS) is used to track cash transactions over $10,000. Since the bail bond business is cash intensive, the information from this system is particularly useful to an IRS auditor. The two forms that are most often encountered are the Form 4789, Currency Transaction Report, and the Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or Business.

Form 4789 is filed by financial institutions when cash is withdrawn or deposited in amounts greater than $10,000. This form identifies the depositor, the business for whom the deposit is made, the amount deposited, and into what bank account the funds are deposited. During an audit, these transactions will be compared with specific cash receipts in your books in an attempt to identify income that was not deposited.

Form 8300 is filed by a bail agent when he or she receives cash in excess of $10,000 in the course of his or her business. A bond with a face value of more than $100,000 probably would generate a bond premium of more than $10,000 for a bail agent and would require a Form 8300 to be filed for that bond on CBRS.

Determining Income

Since books and records are often inadequate in the bail industry, indirect methods are used by the IRS to determine the accuracy of income reported. They will not just accept deposits to your bank account as your total income.

Since most surety contracts require a BUF payment of 1 percent of the bonds written and premiums earned equal to 10 percent of the bonds written, premiums earned for the year can be calculated based upon the total of the BUF payments made for the year. For example, if the total BUF payments are $50,000, the premiums earned on the bonds would equal $500,000. The IRS will compare that figure to the amounts deposited to your bank and reported on the tax return to try and discover differences.

Unfortunately the role of a bail agent today is leaning more towards collection agency due to the increased use of credit bail. The IRS is very likely to focus on uncollected premiums. This is an area where books and records are often lacking. How you track these outstanding bills, what collection procedures are used, and an approximation of the annual percentage of uncollected premiums will be requested by the auditor. This is followed up with an examination of whatever records you have regarding these accounts receivable. It is suggested you automate the collection process with a system that keeps a balance and a record of collections.

Reimbursed Expenses

Bail agents may collect fees from the defendant or his or her guarantor for expenses they incur in tracking and retrieving a defendant for court appearances. Since the bail agent writes off these out-of-pocket costs, any reimbursements of these costs must be included in income. This applies to any Summary Judgment paid by the bail agent for which the bail agent is subsequently reimbursed by, or on behalf of, the defendant.

Collateral

Collateral which is held by a bail agent must be returned upon request of the defendant once the bail is exonerated. However, any collateral returned may be reduced by any uncollected premium or by any other outstanding charges. Please keep in mind the amount retained is income to you. The IRS auditor will compare the collateral received against the collateral returned. They will expect any reductions to have been recorded as income on your tax return.

If a bail agent receives collateral in lieu of all or part of the bond premium, then that portion of the collateral is not a refundable deposit, but rather is taxable income to the bail agent upon receipt. For example, if a defendant pays a 10 percent bail premium by paying 8 percent in cash and posting collateral in the amount of an additional 7 percent in either cash or property, the bail agent has received income in the amount of the full 10 percent bail premium. The additional 5 percent received is treated as a refundable deposit. Please read that again, because I don’t believe many bail agents are treating collateral this way.

Not returning collateral is an area of concern for IRS agents. Accordingly, the bank statements for the collateral account will be inspected to determine if you are using the account properly. That is, whether cash collateral is deposited and returned on a timely basis. The only withdrawals should be for reimbursement of collateral. Any transfers into your operating account should be included in income since they are expense reimbursements.

In the case of bail that has been exonerated, the IRS has argued that after a reasonable period of time, unclaimed cash collateral should be included in income.

It is best not to comingle cash collateral with operating funds. If you do, the IRS will push to have the funds included in income. However, if you can substantiate the identity of the funds as cash collateral and trace it back to the documents, the IRS will consider it collateral and not consider it taxable income. Nevertheless, we strongly recommend you do not commingle collateral funds with your operating account.

BUF Payment Deductions

Payments made by bail agents into BUF accounts are intended to be held as security for the agent’s agreement to indemnify the surety company for any expenses incurred, including Summary Judgments, should the defendant fail to make court appearances as required by the bond. Checks sent in for BUF are not payments against specific liabilities due. In addition, upon termination of the contract between a surety and a bail agent, a surety is contractually required to return the balance of the BUF account to the agent after satisfaction of all outstanding liabilities. It is for these reasons payments made by a bail agent to their BUF account are NOT tax deductable. A tax deduction will arise when a loss payment is made from the BUF account to a court, bounty hunter, attorney, etc.

The issue of whether transfers to a BUF account are deductible when paid was challenged in the courts by a bail agent in the case of Leslie W. Sebring & Nanci M. Sebring v. Commissioner, 93 T.C. 220 (1989). In Sebring, the court held that the payments into the BUF account were deposits held as security for payment of contingent liabilities and were disallowed as deductions. Only payments from this account for specific liabilities were deductible.

In the Internal Revenue Service Bail Bond Industry Audit Technique Guide, it is recommended that the IRS auditor follow this guideline with the understanding that most bail agents take an expense for contributions into their BUF accounts when made. It is recommended that you clearly distinguish your premium payments and BUF payments in your records. The premium payment to the surety is an expense, but the BUF contribution is a refundable deposit. Be sure to maintain a record of disbursements from your BUF account, as those are tax deductible items with the exception of monies returned to you.

Tax Treatment of Bond Costs

In the previous section we mentioned the premium payment to the surety is an expense. Let’s discuss a little known and probably not followed exception.

On a nationwide basis, the average life of a bond is 4 to 6 months, with 90 percent of all bonds falling within this category. However, if the expected life of the bond exceeds 1 year, the bond costs are not currently deductible when paid, but must instead be amortized over the life of the bond. This issue also was decided in court in Seaman v. Commissioner, 84 T.C. 564, 587 (1985); Treas. Reg. section 1.461-1(a).

For example, if a bail agent pays $30 to the surety for a bond which is not exonerated until the following year, the $30 payment must be written off over 2 years ($15 each year). However, the court also logically ruled that if the life of a bond does not extend substantially beyond the close of the taxable year, then a full deduction in the year the bond is written is appropriate. Seaman, 84 T.C. at 587.

Traditional Audit Issues

If you use your car for business purposes, you can deduct car expenses. However, if you also use the car for personal travel, you have to figure the business percentage based on an allocation of miles between business and personal. The IRS will expect you to maintain a log to justify your business travel miles. You generally can use one of the two following methods to figure your deductible expenses, whichever is more beneficial to you.

• Standard mileage rate (currently 55.5 cents per mile for 2012, but increasing to 56.5 cents for 2013).

• Actual car expenses (gas, oil, lease payments, insurance, tolls, repairs, etc.).

Over the years the method used most often has been the actual car expenses. The time required to track mileage each day in a log doesn’t appeal to most busy business people.

If you lease your vehicle, you can deduct the part of each lease payment that is for the use of the vehicle in your business. You cannot deduct any part of a lease payment that is for personal use of the vehicle, such as commuting from home to work.

Unless you have a separate car used ONLY for your bail business, it is recommended to accept the fact that some portion of your vehicle is used for personal usage. Use a reasonable percentage for business and apply that to all of the expenses incurred.

The day to day operations of a small business require purchases from many vendors such as Staples, Poland Springs, Dell, Walmart, and now Amazon. Many times you will make your purchase using a credit card. Please keep in mind you will need to prove to the IRS there was a legitimate business purpose behind the purchase. Offering a credit card receipt or statement simply proves you made a purchase; it does not provide the detail necessary to verify the business purpose. In all cases you will need to provide a detailed receipt from the vendor to the IRS agent if you want to take the deduction as a business expense.

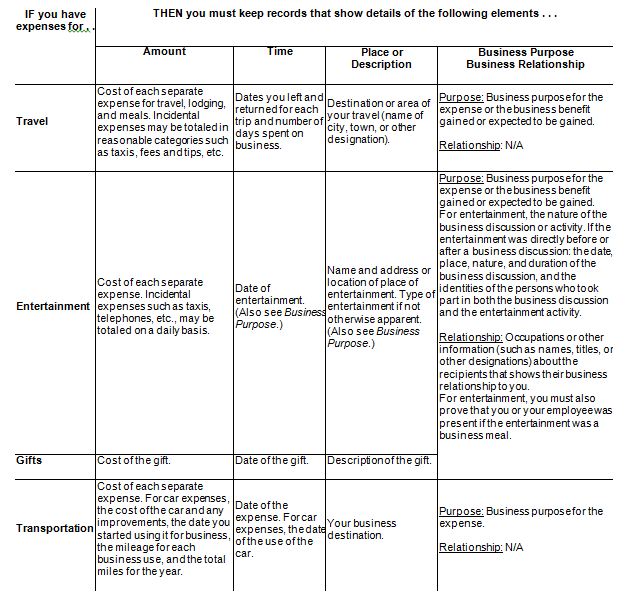

Other areas examined regularly by the IRS are travel, entertainment, gifts and transportation. Below is a table showing the types of records the IRS will expect to see from you if you are claiming an expense.

The following chart shows the various expense records and details you must keep for the following elements . . .

In trying to be reasonable the IRS has indicated in their audit guide that receipts for any of the above expenses, other than lodging, are not required if the expense is less than $75.

The best way to get through an audit, and the best way to ward off subsequent audits, is to maintain good records. The whole experience can only get worse if you have improperly prepared tax returns and inadequate records. Please remember to keep all receipts and tax records for at least three years.

This memorandum is not intended to provide tax advice, but is intended as a general description of federal tax and possible outcomes. This memorandum contains opinions of the author and should not be used by any person or entity for the purpose of making financial or tax decisions or avoiding or reducing taxes or penalties that may be imposed by the Internal Revenue Service. Please consult your tax advisor before taking any actions.